Radial Integration | 2016

Credit Card Processing

Overview

The Payment API and the Risk Assessment API integrate credit card processing between the customer-facing webstore

and the order management system. Two integration configurations are offered:

- A customer-hosted webstore with a customer-hosted order management system

- A customer-hosted webstore with the Radial hosted order management system

Payment Method

There are two basic categories of credit card transactions: Card Not Present and Card Present (face-to-face).

- Card Not Present transaction is made whether the cardholder does not or cannot physically present the card for a merchant's visual

examination at the time that an order is given and payment effected, such as mail-order transactions by mail or fax, over the telephone or the Internet.

- Card Present transaction is a payment card transaction where both the cardholder and merchant are physically present at the time of the sale.

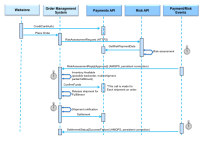

Credit Card Life Cycle: Normal Flow

This flow covers the system interactions that occur for the standard, happy-path credit card use case:

- Credit card checkout in the webstore is successful.

- The order passes the fraud check.

- The order is successfully fulfilled.

- Payment is settled.

Shopper Checkout

- The webstore sends a CreditCardAuthRequest message to the Payment Service and receives an approval.

- The webstore places the order in the order management system.

Order Management

- The order management system sends the order for fraud review via a RiskAssessmentRequest message.

- The order management system waits for a RiskAssessmentReply message to be returned asynchronously via the Advanced Message Queuing Protocol (AMQP).

- The Risk Service uses order and payment data to assess risk. Some orders might be flagged for manual review.

- The Risk Service sends a RiskAssessmentReply message with the result that the order passed its fraud check.

- The order is released for sourcing for fulfillment.

When part or all of the order is available for fulfillment, the following steps are performed:

- The order management system prepares an invoice for the shipment.

- The order management system calls ConfirmFunds to confirm that the payment authorization is still valid for the currency amount of the invoice.

- If the ConfirmFunds response is positive, the shipment is released for fulfillment from the warehouse or third-party shipper.

- The fulfillment system sends a confirmation that the shipment was shipped.

- The order management system calls the

Payment Settlement operation to collect payment on the shipment.

Credit Card Life Cycle: Order Canceled Due to Fraud

This flow covers the system interactions that occur when the risk review rejects an order that used a credit card for payment:

- Credit card checkout in the webstore is successful.

- The order is rejected in the fraud check.

- The credit card authorization is canceled.

Shopper Checkout

- The webstore sends a CreditCardAuthRequest message to the Payment Service and receives an approval.

- The webstore places the order in the order management system.

Order Management

- The order management system sends the order for fraud review via a RiskAssessmentRequest message.

- The order management system waits for a RiskAssessmentReply message to be returned asynchronously via the AMQP.

- The Risk Service uses order and payment data to assess risk. Some orders might be flagged for manual review.

- The Risk Service sends a RiskAssessmentReply message with the result that the order failed its fraud check.

- The order management system cancels the order.

- The order management system sends a PaymentAuthCancelRequest message to the Payment Service to release the authorization hold on the customer's funds.

- The order management system waits for a PaymentAuthCancelReply message to be returned asynchronously via the AMQP.

- The Payment Service sends a PaymentAuthCancelReply message.

Credit Card API Operations

Credit card processing uses the following API operations:

Copyright © 2017 Radial. All rights reserved.