Radial Integration | 2016

The Tax Service API integrates taxes, duties, and fees (TDF) processing. The API provides tax quote processing for the consumer-facing webstore and order management system. The API also provides tax invoice and tax distribute processing for the order management system.

Two integration configurations are offered:

Taxes - All legal taxes applicable based on origin and destination information.

Duties - Any duty applicable on supported international shipments with applicable taxes.

Fees - Any fees applicable on the product or order with applicable taxes.

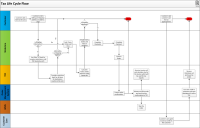

This flow covers the system interactions that occur for taxes, duties, and fees processing:

The client can also receive specific or custom tax reports by working with the Radial tax team.

The following criteria are the main drivers for tax calculations:

Taxes are offered with detailed breakdown for all possible levels. Tax/VAT inclusive and tax/VAT exclusive pricing are supported. Detailed taxes are provided at the line-item level. The Radial tax team can help configure the correct tax nexus template or any special rules that are needed.

The tax class is an important input parameter for tax calculation. The tax class identifies specific taxability such as taxable, tax exempt, and non-taxable. There can be default behavior if a tax class is not present in the input. The customer tax ID is another input configuration that can help provide tax exempt orders output.

The Tax Service supports net or gross taxation pricing to account for any discounts:

The tax duty display preference code is an optional output configuration that can drive client-specific display logic for taxes and fees.

Partner-defined fees and service taxes can be sent in the input. Fees can be item-level, order-level, or both. The default item-level class for tax calculation is 89999. Any input values are ignored. The Radial tax team configures this tax class as tax exempt. Order-level fees can be taxable based on the input tax class.

The Tax Service also returns any additional legal fees such as the Environmental Handling Fee (EHF). The Radial tax team must configure specific requirements for legal fees. Some fees such as the California Electronic Waste Recycling, Advance Disposal Surcharge, Canada Recycling, and Product Care Eco can be offered. These fees are offered as taxable or non-taxable, based on legal requirements.

EHF calculation requires the following:

Any EHF fees sent in the input are ignored and recalculated real-time. EHF is not returned if the invoice type is CREDIT_MEMO.

International Duties and Taxes calculation allows partner to sell and ship their products internationally. The Tax Service classifies the partner catalog and provides APIs to calculate taxes and duties on the order.

The process to calculate taxes and duties on an order is performed in two stages:

Items in the partner’s catalog must be classified before they can be sold online. Classification ensures that accurate taxes and duties are collected from the customer. Partners have the option of choosing which items in their catalog are available to be sold internationally. Some of the important attributes for classification of an item are listed below:

The process flow for Catalog Classification is shown below.

A partner can receive international shipping restrictions either by implementing the Shipping Restriction API or the iShip Restriction Feed. These provide country-level restrictions for countries supported by the International Shipping platform. Partners can use the international shipping restrictions information to prevent customers from placing orders for items in restricted countries, resulting in better customer experience.

Partners can work with the Radial international shipping platform and tax teams for setup, ratings, and configuration.

After products are classified, a partner can use Tax Service APIs to calculate taxes and duties during the checkout process.

A partner can set up their nexus for Canadian provinces by working with Radial Tax team. This setup helps calculate correct taxes on items that are shipped to Canada.

APIs provide duties for each item. Taxes are available on the item amount, shipping amount, and duty of the item. If an item includes gift or custom features then the amount for those features is added to the merchandise amount, and taxes are present under that section.

The process flow for taxes and duties calculation is shown below.

Any discounts and promotions are subtracted from the merchandise amount, and only the net amount is considered for calculating duties and taxes. Discount output from the Tax Service has the same tax breakup as the parent line but shows EffectiveRate, TaxableAmount, ExemptAmount, NonTaxableAmount, and CalculatedTax as zero.

After an order is shipped, the partner must send shipment confirmation, using the Invoice API. If the partner is using Radial Order management system then the Invoice call is taken care of internally.

Taxes, duties, and fees processing uses the following API operations:

Copyright © 2017 Radial. All rights reserved.